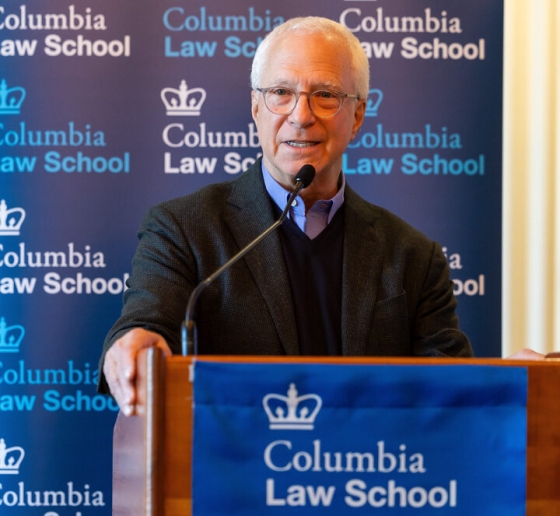

Restructuring Expert Jim Millstein ’82 Delivers 2024 Harvey R. Miller ’59 Lecture

The former chief restructuring officer of the U.S. Treasury Department recounted the chain of events that led to the 2007–2008 financial crisis.

When Jim Millstein ’82 was a third-year associate at Cleary Gottlieb in 1986, he was assigned to represent one of several secured creditors in the Chapter 11 proceedings of an offshore drilling company called Global Marine, which was represented by Harvey R. Miller ’59. “Having never studied bankruptcy law, I was a bit intimidated that I would be sitting around a table with the nation’s leading bankruptcy lawyers,” says Millstein, who knew Miller as a longtime family friend and partner of his father, Ira M. Millstein ’49, at Weil, Gotshal & Manges. “As I walked into the conference room with my British banking group, Harvey screamed across the room, ‘Jimmy! Welcome to the big leagues!’”

Millstein’s anecdote resonated with the audience at Columbia Law School on October 16 that had come to hear him deliver the third annual Harvey R. Miller Lecture, which was established by Weil, Gotshal & Manges to honor the late Columbia Law School lecturer in law, devoted alumnus, and bankruptcy law pioneer. Millstein, who is currently co-chairman of Guggenheim Securities, said that watching Miller at work was a master class in bankruptcy law.

“The Global Marine case taught me the essential problem to be solved in every corporate restructuring is how to equitably allocate the reorganization value among a disparate group of creditors with competing claims to that value, each of whom lent money to their common debtor at different times, at different contractual terms, at different levels in the corporate structure, with different levels of priority,” said Millstein. “Every restructuring is therefore a problem of creditor coordination.”

Now, Millstein is the one who has the expertise to deliver master classes. As the chief restructuring officer of the U.S. Department of the Treasury from 2009 to 2011, he helped recapitalize and restructure troubled companies that had been bailed out by the government, including GMAC (now Ally Financial) and insurance giant American International Group (AIG).

In his introduction of Millstein, Ray C. Schrock, former partner and co-chair of the restructuring department at Weil, recalled working with Millstein on a number of legal matters, including several during the financial crisis. “I can tell you that for any restructuring professional out there, it was, you might say, the Super Bowl of restructuring,” he said. “It was a dark time, and everything was truly at stake. And I think there’s still a lot we can learn from what happened during that time.”

Millstein—a Medal for Excellence honoree and generous alumnus who sits on the advisory board of Columbia Law’s Ira M. Millstein Center for Global Markets and Corporate Ownership—devoted his Miller lecture to the origins, intricacies, and lessons of the financial crisis. He admitted that preparing his talk gave him “a little bit of PTSD” as he reviewed how the collapse of the relatively small subprime mortgage market in 2006 and 2007 “precipitated a financial panic that brought almost every one of the U.S.’s largest financial institutions to the brink of insolvency in the fall of 2008,” he said.

Millstein talked about how the “near-death experience” of the financial system led to the passage of the Dodd–Frank Wall Street Reform and Consumer Protection Act, which resulted in the reworking of the structure of financial regulation. “[It] completely altered the role of the Federal Reserve in the U.S. economy,” Millstein said. “Now the Fed thinks of itself as a market-stabilization entity—it’s not just a central bank taking care of monetary policy and trying to run that in a way to achieve full employment. It’s now basically got every market participant’s back.”

And that gives Millstein pause. “I have my doubts that the empowering of a small group of technocrats and economists to seek to ensure the stability of the financial system hasn’t fundamentally altered the dynamism of our market-based economy,” he said. “But that’s another debate for another day.”