Securities Regulation

Course Information

- Course Number

- L6423

- Curriculum Level

- Upperclass

- Areas of Study

- Administrative Law and Public Policy, Corporate Law, Business, and Finance

- Type

- Lecture

Section 001 Information

Instructor

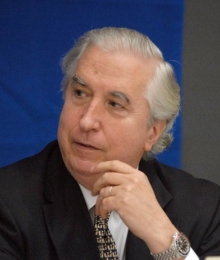

John C. Coffee, Jr.

Adolf A. Berle Professor of Law

John C. Coffee, Jr.

Adolf A. Berle Professor of Law

Section Description

Prerequisite: L6231 Corporations; Open to LLM students who have completed a course in Corporations or Business Associations.

This course focuses on capital raising transactions, beginning with the initial public offering, then moving to offerings by mature companies, then private placements and other exempt offerings. Some attention will be given to derivatives and asset-backed securitizations. Close study of the Securities Act of 1933 and the rules thereunder will be emphasized. Special attention will also be given to the Dodd-Frank Act and the 2008 financial crisis that led up to its enactment. Other major areas of concentration include: (1) the liability provisions of the federal securities laws; (2) the status of crypto-currencies under the securities laws; (3) the alternatives to a standard IPO, including SPACs and direct listings; (4) the extraterritorial application of the federal securities laws (including Regulation S and Rule 144A); and (5) the JOBS Act and other recent deregulatory efforts to simplify and expedite the offering process.

This course will be graded based primarily on a written exam, but some weight will be given to class participation.

This course does not offer writing credit.

The casebook for this course is Coffee, Sale & Whitehead, Securities Regulation: Cases and Materials (14th ed. by Foundation Press). In addition, students must buy and bring to class regularly the statutory supplement, Coffee, Sale & Whitehead, Federal Securities Laws: Selected Statutes, Rules and Forms.

- School Year & Semester

- Fall 2023

- Points

- 4

- Method of Evaluation

- Exam

- J.D Writing Credit?

- No

Learning Outcomes

- Primary

-

- A principal goal is a transactional understanding of the offering process. How do they price and market IPOs? What do underwriters actually do? What is involved in the preparation of a registration statement?

- What are the alternatives to an IPO, including (1) staying private; (2) a "direct listing"; and (3) a SPAC transaction? What are the potential problems with the alternative?

- Another major goal is the problem of systemic risk. How successfully does the Dodd-Frank Act deal with it?

- Have recent deregulatory efforts gone too far? Or is there room for further deregulation? This debate will be informed by pending SEC rule-making under the JOBS Act and recent court decisions.

Course Limitations

- Instructor Pre-requisites

- L6231 Corporations; Open to LLM students who have completed a course in Corporations or Business Associations.

- Instructor Co-Requisites

- None

- Requires Permission

- No

- Recommended Courses

- None

- Other Limitations

- Open to 2L and 3L students and LLMs who have completed (or who are contemporaneously taking) a course in Corporations or Company Law (either here or at their undergraduate law school).