Insider Trading Conference Honors Longtime Columbia Law School Professor

William Cary wrote the 1961 landmark opinion that set the standard for federal insider trading enforcement while chairman of the SEC

New York, November 28, 2012—As chairman of the Securities and Exchange Commission in 1961, longtime Columbia Law School Professor William L. Cary famously delivered an administrative opinion that laid the foundation for modern insider trading law.

Since then, the legacy of his decision has continued to evolve as insider trading prosecutions have taken center stage in the aftermath of the financial crisis.

| (standing) Manuel F. Cohen and Jack M. Whitney III; (seated) Byron D. Woodside, William L. Cary and J. Allen Frear, Jr. Photo courtesy of www.sechistorical.org |

On Nov. 16, practitioners, judges, and professors took time to honor Cary’s legacy at “The Past, Present and Future of Insider Trading: A 50th Anniversary Re-examination of Cady, Roberts and the Revolution it Began,” a daylong conference chaired by John C. Coffee Jr., the Adolf A. Berle Professor of Law.

Cary joined Columbia Law School in 1955 and established himself as a powerful intellectual force. In 1961, President John F. Kennedy appointed him chairman of the SEC.

It was during his tenure as chairman that Cary penned the administrative opinion In re: Cady, Roberts & Co. Before the decision, there were a variety of state rules governing insider trading. Cary articulated the first clear standard under federal securities law: Anyone with non-public material information must disclose it to the market before trading or else abstain from trading. To trade without disclosing would constitute insider trading.

It was during his tenure as chairman that Cary penned the administrative opinion In re: Cady, Roberts & Co. Before the decision, there were a variety of state rules governing insider trading. Cary articulated the first clear standard under federal securities law: Anyone with non-public material information must disclose it to the market before trading or else abstain from trading. To trade without disclosing would constitute insider trading.

“Bill Cary lived in simpler times when regulators had the ability to regulate and we trusted them to do so,” said Coffee, director of the Law School’s Center on Corporate Governance. “We’re better off because the SEC was able to say in 1961” that insider trading is illegal under federal law.

In 1964, Cary left Washington, D.C., and returned to Columbia Law School as the Dwight Professor—a position named in honor of the Law School’s first professor, Theodore W. Dwight.

In 1964, Cary left Washington, D.C., and returned to Columbia Law School as the Dwight Professor—a position named in honor of the Law School’s first professor, Theodore W. Dwight.

|

Coffee and other panelists paid tribute to Cary throughout the conference, noting he commanded respect.

Meyer Eisenberg ’58, an adjunct senior research scholar and lecturer-in-law at Columbia Law School, enrolled the same time Cary joined the faculty.

“His legacy is much broader than just Cady, Roberts,” Eisenberg said.

Cary served in the U.S. Marine Corps during World War II and earned promotion to the rank of major, according to his 1983 obituary in the New York Times. In 1944 and 1945, he travelled to Romania and what was then Yugoslavia as an officer in the Office of Strategic Services.

After joining Columbia Law School, he taught corporate and tax law until his retirement in 1979. In one of many accomplishments, he wrote “Federalism and Corporate Law: Reflections on Delaware,” an article that appeared in the Yale Law Journal in 1974 and called for national standards for corporate governance.

“His legacy is much broader than just Cady, Roberts,” Eisenberg said.

Cary served in the U.S. Marine Corps during World War II and earned promotion to the rank of major, according to his 1983 obituary in the New York Times. In 1944 and 1945, he travelled to Romania and what was then Yugoslavia as an officer in the Office of Strategic Services.

After joining Columbia Law School, he taught corporate and tax law until his retirement in 1979. In one of many accomplishments, he wrote “Federalism and Corporate Law: Reflections on Delaware,” an article that appeared in the Yale Law Journal in 1974 and called for national standards for corporate governance.

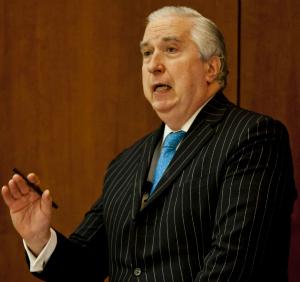

| Stephen J. Crimmins '73 |

As a professor, Cary taught courses on The Securities Act of 1933, corporations, and business planning. One of Cary's students, Stephen J. Crimmins '73, of K&L Gates, said Cary often sat with students dunking donuts during the student coffee hour. And, in the classroom, Cary was a master: He had written the case book used in corporations and his experience as SEC chairman made his insights invaluable.

Crimmins said Cary was low-key in his presentation style, “but his sentences were packed with thought and analysis.”

“He absolutely was the world class professor to have in any class,” said Crimmins, who was a panelist at the conference. “And as far as his personal qualities, he cared about us and he would approach us and he was just a wonderful human being.”

Crimmins said Cary was low-key in his presentation style, “but his sentences were packed with thought and analysis.”

“He absolutely was the world class professor to have in any class,” said Crimmins, who was a panelist at the conference. “And as far as his personal qualities, he cared about us and he would approach us and he was just a wonderful human being.”

The conference was sponsored by the Law School’s Center on Corporate Governance with additional support from the Securities Law Section of the Federal Bar Association, The Stephen Friedman Fund in Business Law, and the F.F. Randolph Jr. Speakers Fund.