Columbia Law School Convenes Gathering of Leading Experts in Securities Law

Center on Corporate Governance Hosts Annual Conference Tackling Hot Topics in Securities Regulation

New York, May 10, 2016—Many of the nation’s leading securities experts gathered at Columbia Law School recently to discuss the latest developments in financial markets, securities law, and enforcement.

The daylong 2016 Securities Regulation Conference brought together judges, practitioners, academics, and government regulators to tackle such cutting-edge topics as hedge fund activism; insider trading and enforcement; the future of the Public Company Accounting Oversight Board (PCAOB); and mutual fund regulation after the 2015 meltdown of Third Avenue Management.

The April 29 event, hosted by the Law School’s Center on Corporate Governance, was organized by center Director John C. Coffee Jr., the Adolf A. Berle Professor of Law, and former U.S. Securities and Exchange Commission Deputy General Counsel Meyer Eisenberg ’58, an adjunct senior research scholar and lecturer in law at the Law School. The conference received support from the Stephen Friedman Fund in Business Law and the Securities Law Section of the Federal Bar Association.

Sparking Debate

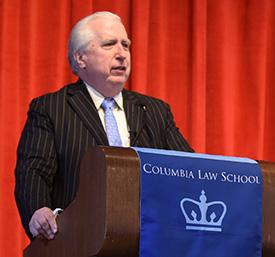

A foremost scholar on securities law, Coffee kicked off the proceedings by providing “the logic and rationale” behind this meeting of top minds in the subject area.

| Professor John C. Coffee, Jr., director of Columbia Law School's Center on Corporate Governance, welcomes attendees of the 2016 Securities Regulation Conference. |

“I have invited the people that I admire most in this profession, or that I respect the most, and many of them fall into both categories,” Coffee said. “Either I think you are someone who deserves a great deal of attention and thanks for your work, or I think you’re one of the best leaders in the field. My goal is to throw [the participants] together on four panels today, and force them to disagree and explain their rationale.”

For nearly 13 years, Columbia Law School’s Center on Corporate Governance has been “a leading vehicle for conversation and critical engagement around a wide range of topics at the intersection of corporate governance, securities regulation, and business law more broadly,” said Gillian Lester, Dean and the Lucy G. Moses Professor of Law, who welcomed the guests and, in doing so, praised Coffee. “We’re constantly enriched by his scholarly contributions and wide-ranging network of academics, practitioners, and regulators, the sort of people—all of you—that he was able to bring together here today.”

Donaldson Keynote

The conference keynote event was a lunchtime discussion with former SEC Chairman William Donaldson.

| Former SEC Chairman William Donaldson talks about his long career and the current challenges facing the SEC in his keynote discussion with Professor John C. Coffee, Jr. at the 2016 Securities Regulation Conference. |

In his introduction, Coffee noted Donaldson’s storied career: He founded the pioneer brokerage firm of Donaldson, Lufkin and Jenrette; served as an undersecretary of state to Henry Kissinger and an adviser to U.S. Vice President Nelson Rockefeller; acted as the founding dean of the Yale School of Management; became president and CEO of the health insurance company Aetna; led the New York Stock Exchange; and was named chairman of the SEC, serving from 2003 to 2005.

“Looking back, I’ve got to say, leaving in 2005 was a brilliant stroke of timing,” Coffee observed to laughter. “It couldn’t get better.”

At the age of 84, Donaldson remains active. Last year, he joined former Federal Reserve Chair Paul Volcker at the Volcker Alliance, a group dedicated to “rekindling” people’s trust in government institutions, as well as their interest in public policy and service.

In his wide-ranging discussion with Coffee, Donaldson touched on current and future challenges facing the SEC.

| Students review the conference program before the keynote lunch conversation begins. |

In his two years at the helm of the agency, Donaldson stressed bipartisanship; he ended up allied with two Democratic commissioners—and against his two fellow Republican commissioners—to pass new rules regulating hedge and mutual funds. In the aftermath of the Enron, WorldCom, and Tyco accounting scandals, he also worked to improve financial disclosure. But the political divisions took their toll, he said, and may have undermined the agency’s efforts. “There should be no politics,” said Donaldson, calling today’s highly partisan climate “too bad” and a prime promoter of public skepticism.

“The general public doesn’t understand the mission of the SEC, which is investor protection,” he said. “Clearly, the atmosphere in the country today, particularly post-2008, is that there are not too many investors who think they’ve been protected too well.”

Stronger, tougher enforcement is required, according to Donaldson. “The general public is right in thinking, with everything that’s gone on in this country, that there aren’t more people higher up in corporate America . . . who have paid the price for malfeasance,” he said. The underlying problem may not have been “too big to fail,” but “too big to manage itself correctly.”

Shortsighted Troubles

Coffee brought up Donaldson’s push at the SEC for the 2005 adoption of Regulation NMS, which sought to strengthen and modernize the national market system in light of new markets and technologies. “That may have had some unintended consequences,” Coffee said. “There are people who believe that process gave excessive emphasis to speed.”

| Former SEC chairman William Donaldson, in conversation with Professor John C. Coffee Jr. during the Securities Regulation Conference luncheon, takes a question from the audience. |

Controversy has surrounded the explosive growth of high-frequency trading, or the use of powerful computers in recurrent, algorithmic stock transactions. Critics say high-frequency trading poses new risks and volatility problems for the financial system. Several European countries have proposed curtailing or banning the practice.

In an effort to exploit minor price differences across different exchanges, high-frequency trading can unleash millions of orders in a fraction of a second, before canceling most of them. Donaldson compared it to the old-school practice of unethical floor traders “front-running” ahead of larger orders en route to a specialist’s post. “Now that has evolved into the most unbelievable machinery and equipment,” he said. “We have had a breakdown, in my view, of what I think in theory is the best market in the world, which is where all buyers and sellers get together in the same place.” He faulted the “total fractionalization” of markets—including private exchanges—for decreasing disclosure and transparency. He agreed with Coffee’s assessment that the SEC will likely grant the Investor’s Exchange, or IEX (which would introduce a microsecond “speed bump” to foil high-frequency traders) a license to become the country’s 14th stock exchange.

“There’s a lot of pressure put on the SEC to slow down” stock trading, Donaldson said. “The concept of a speed bump to slow down this ridiculous speed is a good one.”

As the conversation delved into high-frequency trading, criticism of ratings agencies, and the worth of quarterly reporting, Donaldson found the common problem to be an emphasis on short-term gains.

“It seems to me there’s a detriment to what I would hope would be the long-term purchase of equities, [and] running a company for the long term. It’s in everybody’s interest to be able to become a shareholder and to hold it for the long haul,” he said.

“We have too much action on the surface, and too little incentive for long-term management of corporations. You may detect in my feelings I’m violently against short-term trading, violently against the amount of effort in this country right now to take advantage of that by high-speed techniques and all of that which really have nothing to do with the valuation of equities.”

Meeting of Minds

The panel discussions were held throughout the day. A detailed listing of these panels and speakers follows. Videos of the conference will be posted here.

| Jack B. Jacobs (left) and Charles Nathan (right) on the Hedge Fund Activism panel (left); and Mark F. Pomerantz (left) and the Honorable Jed S. Rakoff (right) on the Enforcement and Insider Trading panel (right) |

Investment Companies: Regulatory Policies and Risk Management after Third Avenue

Moderator: Meyer Eisenberg ’58, Adjunct Senior Research Scholar and Lecturer in Law, Columbia Law School; former Deputy General Counsel and Acting Director, Division of Investment Management, SEC

Panelists:

Diane E. Ambler, Partner, K&L Gates LLP; Adjunct Professor, Georgetown University;

Ronald J. Gilson, Marc and Eva Stern Professor of Law and Business, Columbia Law School; Charles J. Meyers Professor of Law and Business, Stanford Law School;

David W. Grim, Director, Division of Investment Management, SEC; and

Nora M. Jordan, Partner and Chair of the Investment Management Group, Davis Polk & Wardwell LLP

The Future of the PCAOB

James R. Doty, Chairman, PCAOB

Interviewed by Professor Coffee.

Keynote speaker: William Donaldson, former Chairman, SEC; former CEO, NYSE, in conversation with Professor Coffee

Hedge Fund Activism

Moderator: Professor John C. Coffee Jr., the Adolf A. Berle Professor of Law and director of Columbia Law School’s Center on Corporate Governance

Panelists:

William Anderson, Evercore Group L.L.C.;

Stephen Fraidin, COO, Pershing Square Capital;

Jack B. Jacobs, Sr. Counsel, Sidley Austin LLP, retired Justice, Delaware Supreme Court;

Martin Lipton, Partner, Wachtell, Lipton, Rosen & Katz; and

Charles Nathan, Sr. Adviser, Finsbury

Enforcement and Insider Trading

Moderator: Professor John C. Coffee, Jr.

Panelists:

Andrew J. Ceresney, Director, Division of Enforcement, SEC;

Stephen J. Crimmins ’73, Murphy & McGonigle;

Edward F. Greene, Sr. Counsel, Cleary, Gottlieb, Steen & Hamilton LLP; former Director, Division of Corporation Finance and General Counsel, SEC;

Mark Lebovitch, Partner, Bernstein Litowitz, Berger & Grossman LLP;

Mark F. Pomerantz, Of Counsel, Paul, Weiss, Rifkind, Wharton & Garrison LLP; and

the Honorable Jed S. Rakoff, United States District Judge (S.D.N.Y.)